Even though every country has its own distinct characteristics, we have collected a list of broad trends across Asia to provide the big picture of what is happening in the region.

These are the main consumer trends in Asia in 2025:

Online Shopping Revolution

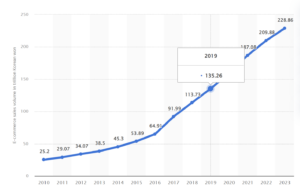

This trend is rising worldwide, but it is especially noticeable in countries such as China, Japan, or South Korea, where the advanced digital infrastructure enabled a rapid shift to online.

In South Korea, online shopping transactions have been continuously on the rise throughout the current decade, experiencing a 43% increase in transaction volume from 2020 to 2025. China has also seen growth in this sector, with the online shopping penetration reaching 82.3% of internet users as of 2025, 1.82% decreased from 2024 (Statista, 2025). Despite this, China has remained the largest e-commerce market since 2013.

China’s hold on eCommerce in the region has been strengthening, as two of its largest platforms – Temu and AliExpress – have been expanding internationally. Temu was launched in Japan and South Korea in 2022, and hit the ground running, reaching 8.29 million monthly active users (MAUs) in South Korea within its first 9 months in the country (Korea Times), and topping the Google and iOS play stores in Japan for 101 days (CNBC). The platform also entered Southeast Asia at the same time, launching in Malaysia and the Philippines.

AliExpress’ international growth has been slower, launching in South Korea in 2018, but it has recently been experiencing a lot of growth in the country, reaching over 8.2 million monthly active users in 2025. This has made it the second most visited eCommerce platform in a country that has been traditionally dominated by domestic players (Korea Times).

It is interesting to note that both of these sites are pursuing a price competitiveness strategy, which may be signaling that consumers in the APAC region are more focused on price. It will be interesting to see how other eCommerce platforms react to this growth, whether they’ll adopt a similar strategy or find new ways to stick out in the marketplace.

Consumers are going local

Consumers are getting more conscious of the impact of their purchasing power. In 2025, there will be a big trend for supporting local brands.

In some Asian markets, like Indonesia, Singapore, South Korea, and Japan, there is a noticeable emphasis on hyper-localization, where consumers are willing to support small businesses in their local neighborhoods, particularly in the hospitality sector.

On the other hand, in countries like India and China, the government is leading a push towards national products. These initiatives resonated quite well with Indian consumers who are willing to go local to help revive the economy. Also in China, the demand for national brands has been growing recently, motivated by both the growth in the quality of Chinese brands and international trade tensions.

While local brands can easily connect with consumers by emphasizing their heritage, global brands need to demonstrate a real understanding of each market and its unique culture. Localizing marketing efforts is more important than ever.

Seeking Reliable Brands

Social Consciousness is a trend that we can see worldwide and was especially noticeable in the Black Lives Matter movement‘s hold on social media a few years ago. Consumers are paying more attention to the companies they are buying from and focusing on the values the brands communicate.

In Southeast Asia, digital consumers have always been open to trying new brands, with purchasing habits largely inspired by an openness to digital discovery. However, in the past few years, we have seen a strong preference for trusted and established brands that have a robust consumer trust.

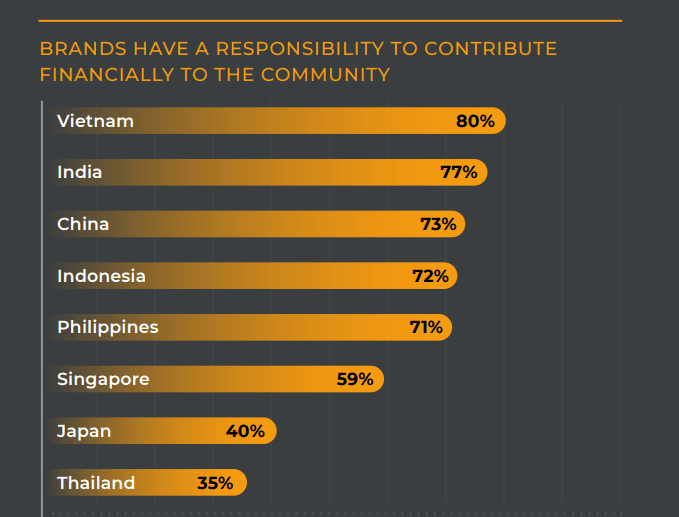

Similar to this, in a recent study conducted by Kadence, 62% of Asian consumers believe that organizations have the responsibility to contribute to their communities.

By 2025, brands should lead meaningful initiatives (beyond donations) to be on the same page as consumers. Companies should stop being all talk and take action, and not only in B2C industries.

Good Social Media Management could be a brand’s best ally to demonstrate brand transparency and show evidence of the actions they are taking. Engaging with users by answering difficult questions and openly admitting to mistakes are other ways to build trust with them.

Health is Wealth

It is no surprise that for 2025, healthcare is going to be top of the agenda for many consumers. 87% of Chinese consumers consider wellness as a top priority, according to a survey conducted by McKinsey. 85% of Chinese respondents in that same survey also mentioned an increase in wellness products specifically marketed as “anti-aging”. South Korea’s health and wellness industry is also going strong, with the industry’s total worth jumping from $94.4 billion in 2020 to $113 billion in 2022, just two years later (Global Wellness Institute).

It is also interesting that the lockdowns a few years ago, in countries like China, have raised awareness of the importance of having good mental health. According to research from PwC, 87% of Chinese consumers are focused on taking better care of their mental health by investing time in themselves. For example, 79% of Chinese consumers think grooming routines are a good way to reduce stress.

As consumers become more interested in taking care of themselves and the planet, they gravitate to models that make their lives simpler and with a lesser impact on the environment.

Continue reading about the APAC trends:

- APAC E-commerce in 2025;

- APAC Tourism Trends in 2025;

- APAC Mobile Gaming Marketing in 2025;

- APAC TikTok Marketing in 2025.